Principle 7: Impact at Exit

The Common & Emerging Practices, a new series of resources from the Impact Principles, aims to capture key insights from notable trends in common practices in implementing the Impact Principles by our Signatories and highlight promising emerging practices and key gaps. By sharing these common and emerging best practices in impact management, we seek to elevate impact practice in the market and ensure that capital is mobilized at scale with integrity to drive meaningful impact outcomes.

The resources related to Common & Emerging Practices will be released in phases through website publication of initial drafts for each of the nine principles in series, followed by draft and final consolidated reports with stakeholder engagement.

![]() Click here to learn more about the Common & Emerging Practices series.

Click here to learn more about the Common & Emerging Practices series.

![]() Click here to sign up for ongoing updates or to provide your feedback.

Click here to sign up for ongoing updates or to provide your feedback.

Overview

—

Exit considerations are especially consequential for impact investors, as the realization of their long-term impact objectives often extends beyond their holding period. Exits may carry risks of undoing previously achieved impact or seeing strategies abandoned post exit or under new ownership. For this reason, for impact investors, exits provide an important opportunity to advance the pursuit and preservation of impact while generating a financial return.

CHALLENGES IN THE IMPLEMENTATION OF PRINCIPLE 7

Principle 7 is a work-in-progress for much of the market with unique challenges and varying implementation approaches across asset classes. This in part reflects the impact investing market’s ongoing maturation, as many Signatories are only beginning to navigate exits. Other frequently mentioned challenges in implementing Principle 7 include:

Financial trade-off and fiduciary constraints: While a growing number of business models demonstrate strong alignment between impact and financial returns, many impact investors still navigate real or perceived trade-offs where maximizing financial performance may come at the expense of sustained impact. Balancing these dynamics while fulfilling fiduciary responsibilities can be a complex challenge for impact investors.

Deal tensions: Various and competing stakeholder interests, demanding timelines, and other transaction pressures can complicate the process of managing exits, which can undermine the ability to prioritize sustained impact or incorporate it into sales documents.

Knowledge gaps: Limited specialized expertise and practical guidance on exit-related impact practices and examples leave many impact investors insufficiently equipped to effectively integrate impact considerations into their exit strategies and implementation.

Market conditions limiting liquidity: Limited exit options or liquidity for impact-driven assets, especially in private markets, can create structural barriers, making it difficult for investors to identify and engage with buyers who align with and value their impact objectives.

No established exit policy: The absence of clearly defined and formal exit-related policies or processes during the initial investment phase can restrict investors’ ability to address impact considerations when the time comes to exit, leading to missed opportunities for long-term impact sustainability.

KEY OBSERVATIONS IN THE IMPLEMENTATION OF PRINCIPLE 7

Despite challenges, the latest Disclosure Statements reveal significant progress in managing responsible exits since the launch of the Impact Principles.

While much of the discourse is still centered around the private equity asset class, an increasing number of investors in private and public debt, real assets, and public equity markets are recognizing the importance of integrating impact considerations when developing and executing an exit strategy. This trend also indicates the potential for exit-related practices to develop and advance in parallel with the impact investing market as it scales and matures. These practices will help investors to proactively address the challenges mentioned above while strengthening the sustained impact potential of their investments.

Notable observations include:

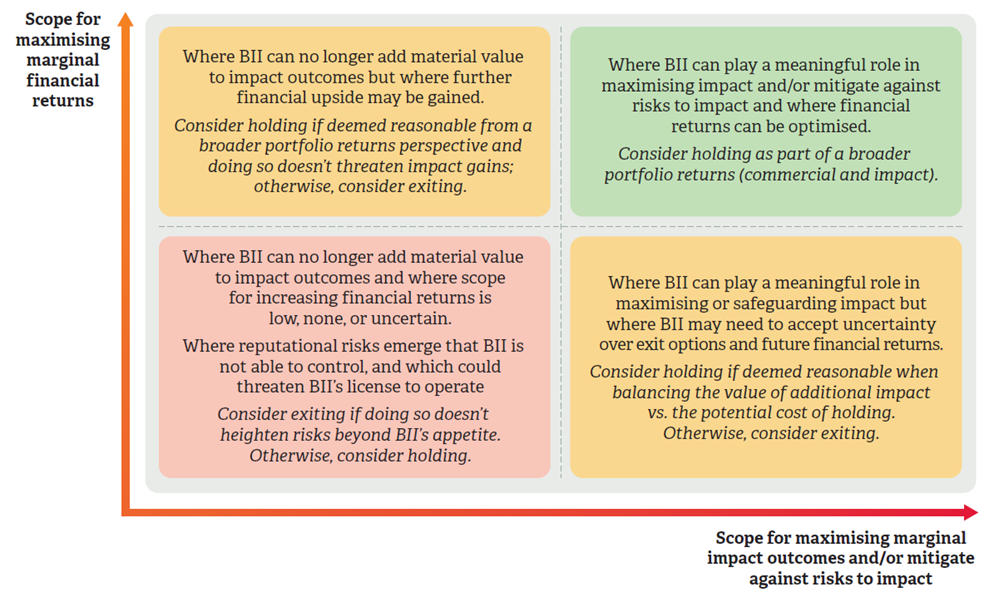

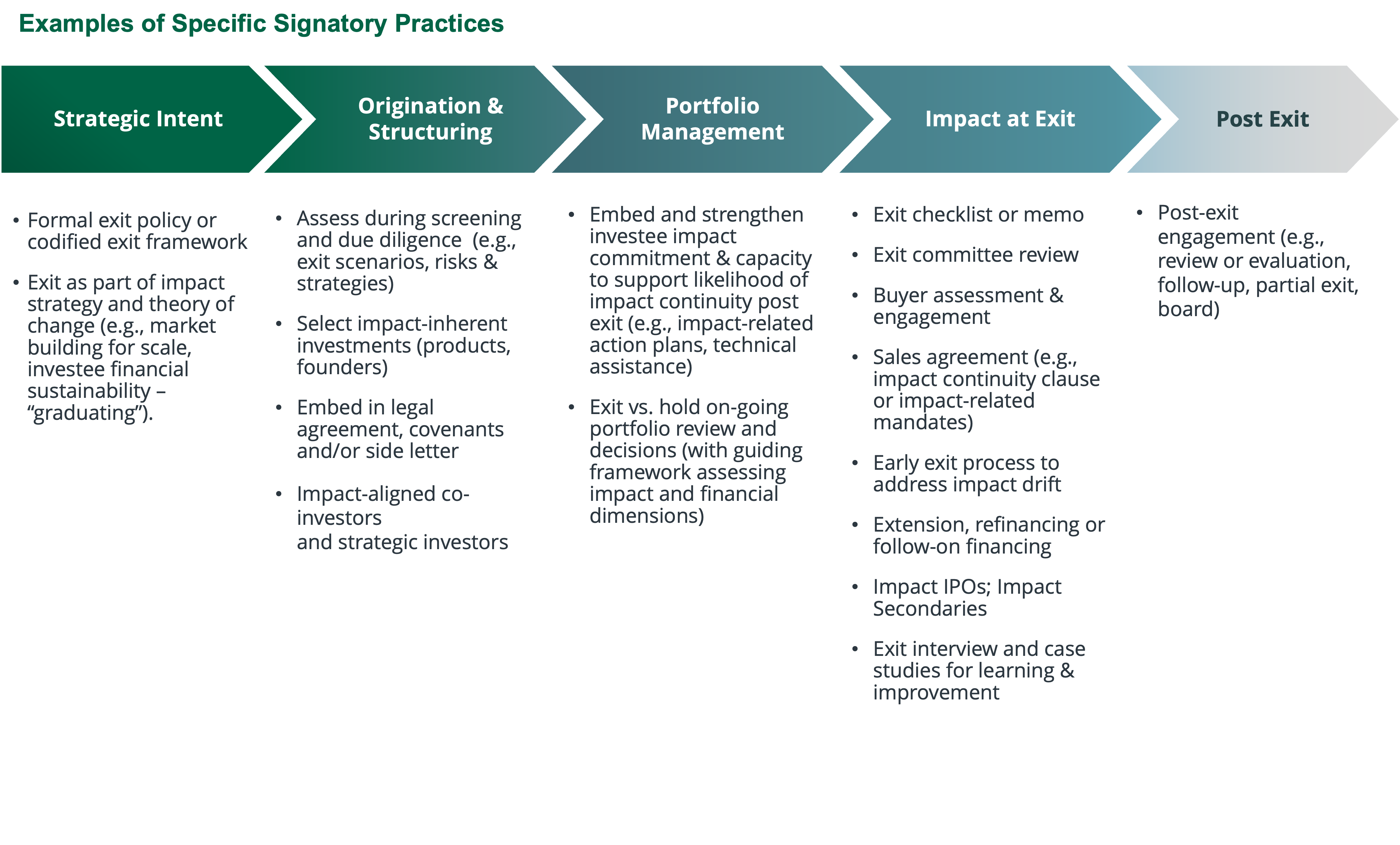

Across investment lifecycle: Exit considerations are not confined to the final stages of the investment process but integrated across the entire lifecycle of an investment. This approach begins at the pre-investment phase, where exit strategies are embedded into due diligence and deal structuring decisions and continues throughout the holding period and sometimes post-exit. [See Exhibit 7a].

—

EXHIBIT 7a. Integrating Sustained Impact at Exit Considerations Across Investment Lifecycle

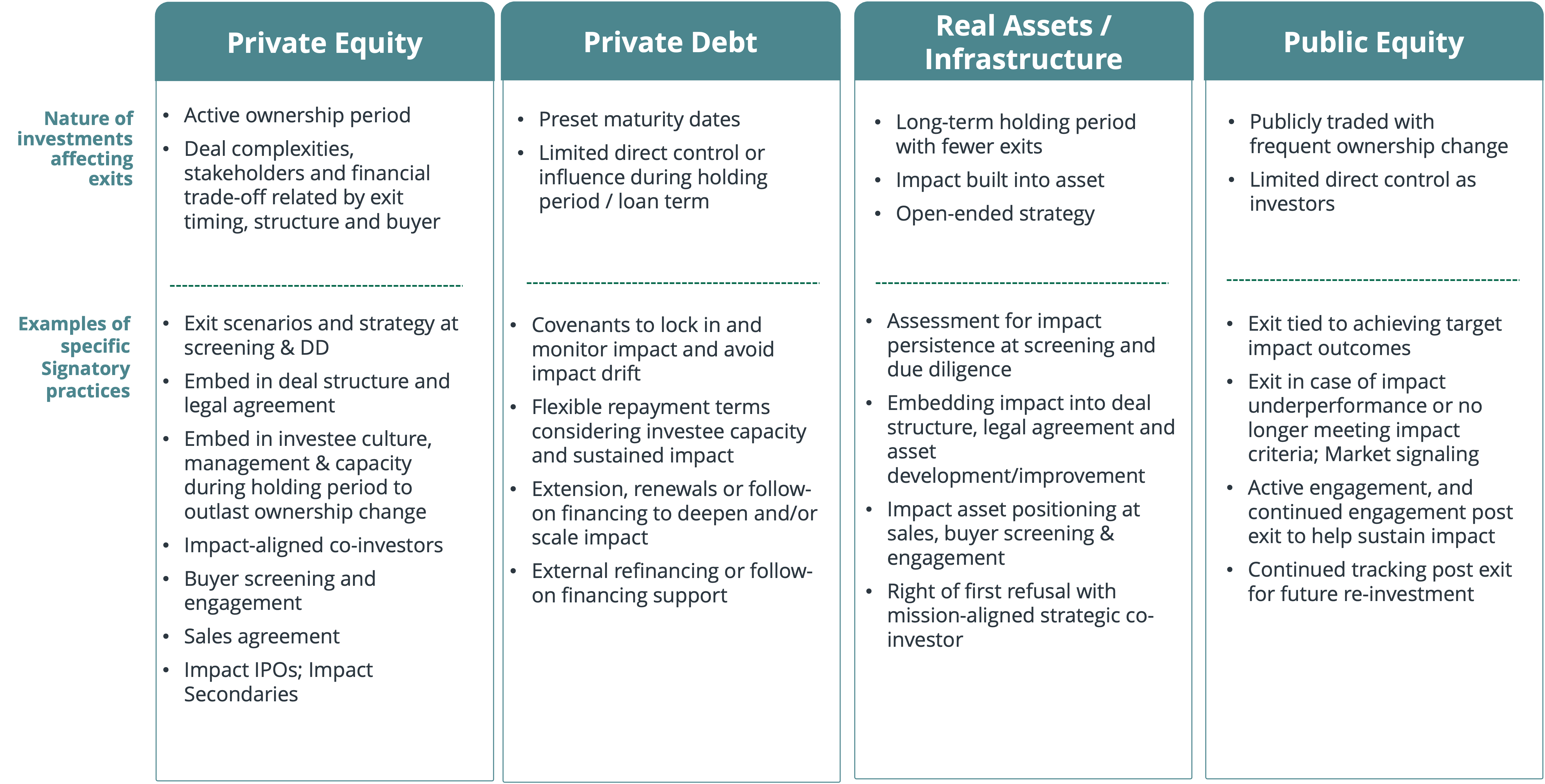

Asset class variance: The practices for managing exits vary across asset classes given the distinct characteristics of the assets and ownership that influence structure, timing, and process of exit. The differences highlight the need for tailored impact-driven exit approaches that align with the nuances of each asset class. [See Exhibit 7b]

—

EXHIBIT 7b. Implementation of Principle 7 Across Asset Classes: Example Practices

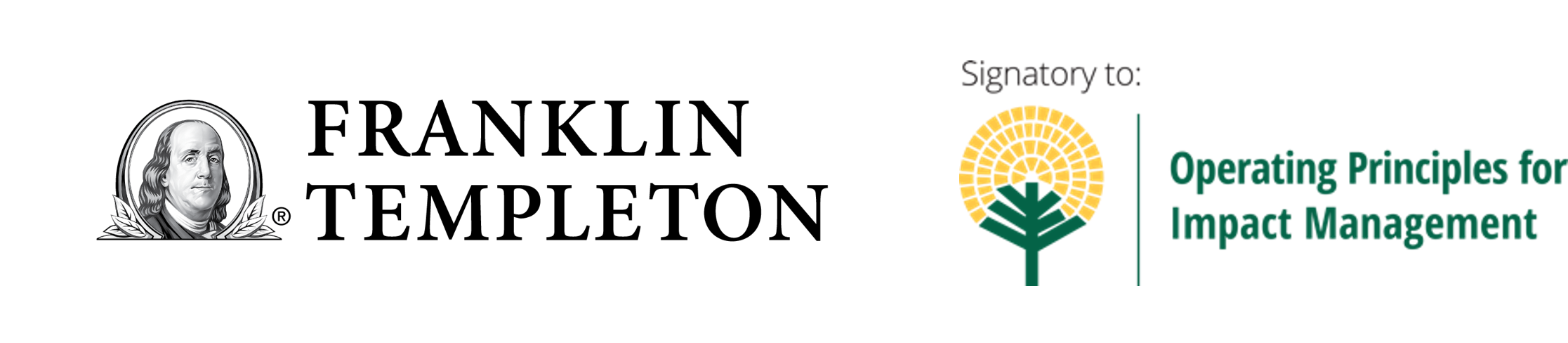

Formalizing exit intentionality: A formal policy or codified framework can help to institutionalize integrating exit consideration throughout the investment lifecycle with a consistent approach, rigor, and comparability across a portfolio. Some investors with diverse portfolios have developed approaches that can be broadly applied across multiple asset classes.

Influencing factors on exit decisions: Influence over exit decisions depends on a range of factors including ownership share, investment structure, governance, and management alignment, while also balancing against the portfolio’s financial return with regard to fiduciary duty.

Impact as value driver vs. trade-off: While balancing impact against financial return and fiduciary duties is central to exit considerations, there is also an increasing recognition that impact can be a source of financial value creation rather than dilution. Investors also safeguard long-term, sustained impact beyond exit by investing in colinear models where impact is entrenched in the business strategy, as well as by further embedding impact capacity into the business operations.

Role of LPs in sustaining impact at exit: Limited partners (LPs), especially those who are impact-aligned, can play an important role in ensuring that sustained impact is prioritized during exits. LPs may include assessment of exit-related policies or processes in their due diligence of general partners (GPs) or funds as well as in ongoing engagement, monitoring, and reporting.

Amplifying impact at exit: Some Signatories intentionally use exits as opportunities to scale and deepen impact beyond their ownership – for example, by facilitating impact secondaries, supporting impact IPOs, or engaging impact-aligned strategic investors as a pathway to accelerate growth while mobilizing scale capital. Re-financing, follow-on financing, or extension in case of debt can be opportunities for deepening impact with investees.

Long-term holding: Certain investments are intended for long-term holding with fewer or no exits and have impact considerations built into the assets. Open-end fund structures, especially in real estate with potential for “buy, fix, and hold” or “build and hold” approaches, may eliminate the risk of hand-off to a non-impact aligned manager.

Common, Emerging & Nascent Practices in the Implementation of Principle 7

—

Note: The findings and observations are primarily based on analysis of the most recently published 166 Signatory Disclosure Statements at the time of the review in early to mid-2024.

The disclosures on the implementation of Principle 7 show a spectrum of practices which together reflect the growing sophistication of impact investors in balancing the long-term sustainability and advancement of impact alongside financial outcomes. More investors are starting to incorporate impact into their exit-related processes, often starting at pre-investment stages which provide a foundation for responsible exits across asset classes. Emerging and nascent practices illustrate a move toward more specific and formalized approaches, such as the use of detailed exit review checklists, codified exit policies or frameworks, buyer alignment assessments, legal agreements, and exit committee reviews.

Considering sustained impact during exit process. 66% disclosed specific ways in which they consider the effect that the timing, structure, or process of the exit will have on the sustainability of impact.

Considering sustained impact at exit during pre-investment. 52% disclosed planning for and safeguarding sustained impact at exit during the pre-investment phase through their origination, screening, assessment, and structuring of the deals.

![]()

Assessment during screening and due diligence. 36% disclosed considering the potential for sustainability of impact at exit during screening and due diligence processes. These may include explicit screening and due diligence criteria and exit-related content in the investment memo, including analysis of exit scenarios, risks and strategies. Related to this, selecting impact-inherent investments, including in products or founders, is also mentioned as a way to safeguard sustained impact beyond exit, outlasting the Signatories’ ownership.

Exit review checklist or memo. 27% disclosed having an exit review checklist or memorandum prepared, outlining the process followed prior to exit, including timing, structure, and selection of buyer.

![]()

Buyer assessment and engagement. 20% disclosed assessing or engaging with the potential buyer to ensure and support alignment and buy-in of impact objectives as a key component to safeguarding the sustainability of impact post transfer of ownership.

Exit committee review. 14% disclosed having either a separate exit committee or an existing investment or impact-related committee review sustained impact considerations at exit for approval, including through exit checklist or memo.

Legal agreement, covenants or side letter. 13%, particularly those investing in private debt and loans, disclosed addressing sustaining impact at exit within the origination documents, covenants or side letters.

Termination or early exit process to address impact drift. 11% disclosed having a process for an early exit to address instances of impact drift, meaning a company no longer meeting the impact criteria or a company that no longer adheres to agreed upon policies. In such cases, minimizing risks or negative impact becomes the more important concern.

Extension, refinancing or follow-on financing. 10%disclosed having established criteria or procedures for refinancing or follow-on financing to continue to support the investee and sustain or deepen the impact.

Formal exit policy. 6% disclosed having a formal exit policy or codified framework to guide broad portfolio, fund- or firm-level approaches to exit in a comprehensive and consistent manner.

Sales agreement. 5% disclosed having a sales agreement that includes clauses with requirements that support the sustainability of the exit.

Post-exit review or follow-up. 5% disclosed conducting reviews of investments or investee post-exit to determine how the impact has been sustained over time. In some cases, this may take the form of a partial exit or having a continued board seat. Related, exit interviews and case studies, shortly after exit, are also used to support continued learning and improvement.

Principle 7 Signatory Practice Spotlights

—