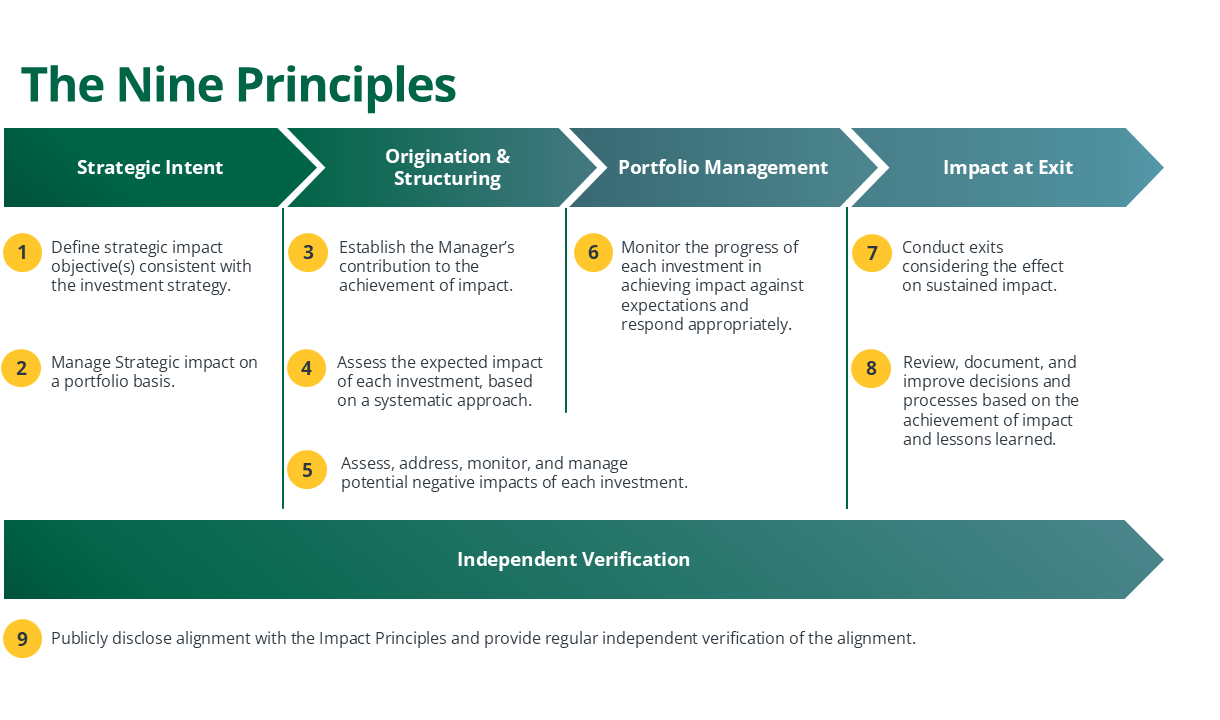

THE 9 PRINCIPLES

The Impact Principles provide an end-to-end framework of best practices for investors in the design, implementation and continuous improvement of their impact management systems and processes, ensuring that impact considerations are integrated throughout the investment lifecycle. By aligning with the Impact Principles, investors are committing to a global standard on what it means to be an impact investor in “practice,” thereby improving investor confidence and integrity and elevating impact practices while also addressing concerns related to impact-washing. As a global standard, the Impact Principles provide a reference point against which the impact management systems of funds and institutions may be assessed. They also provide an important mechanism for transparency and accountability for impact management in the capital markets through the Principle 9 requirement for annual disclosures and periodic independent verification of an investor’s alignment with the Impact Principles.

Universal Applicability of the Impact Principles

The Impact Principles are applicable to all types of investors, including different sizes, asset classes, sectors, and geographies. The Impact Principles may be adopted at the corporate, line of business, fund, or investment vehicle level. The way in which the Impact Principles are applied will vary by type of investor. They may be implemented through different types of systems, each of which can be designed to fit the needs of an individual organization. The Impact Principles do not prescribe specific tools and approaches, nor specific impact measurement frameworks – instead, the Principles are designed to guide investors in the development, implementation and continuous improvement of their impact management systems and processes across the full investment lifecycle.

Benefits of adopting the Impact Principles

The Impact Principles provide a critical component of market infrastructure that is necessary for scaling impact with integrity. Disciplined impact management practice is essential for mobilizing capital with investor confidence and ultimately delivering impact outcomes at scale. Standard practice for impact management across global capital market enables market efficiency, comparability and advancement based on best practices and shared learning.

For All Investors

- Best practice roadmap: Design and implement an IMM (Impact Measurement and Management) system that is aligned with global standards and stay up-to-date on best practices in the industry

- Investor confidence: Enable systematic and informed decision-making for impact across the investment lifecycle from strategy design to exit Impact leadership: Demonstrate leadership and commitment to advancing impact practice by contributing to knowledge and field-building initiatives

- Learning and collaboration: Access knowledge on IMM best practices via in-depth peer learning and collaboration opportunities

- Peer network: Join a global community of like-minded investors committed to developing market best practices and building the infrastructure critical for scaling the impact investing market with integrity

For Asset Managers

- Market credibility: Signal credibility to LPs/investors and peers, particularly during fundraising, by committing to alignment with the Impact Principles

- “Walk the talk”: Back up claims of impact by embracing transparency and accountability via regular disclosures and independent verification

For Asset Owners and Allocators

- LP-GP relations: Improve LP-GP relations on impact via better communication and a shared understanding of expectations for impact

- Portfolio management: Ensure managers across different asset classes and impact themes are held to a common standard of practice

Contact us to learn more at secretariat@impactprinciples.org

An Overview of the Impact Principles: English, Spanish, German